- Four-year, secured A$10 million debt facility with PURE Asset Management

- Facility to fund Kleos operations and constellation growth

Kleos Space S.A (ASX: KSS, Frankfurt: KS1, Kleos or Company), a space-powered Radio Frequency Reconnaissance data-as-a-service (DaaS) and Mission-as-a-Service (MaaS) provider, has secured a four-year secured A$10 million debt facility under a binding term sheet with PURE Asset Management Pty Ltd (PURE) to fund operations and satellite constellation growth.

Commenting on the debt facility, Kleos CEO Andy Bowyer said, “Kleos is in a period of rapid growth, responding to market needs for greater situational awareness. This debt facility provides us with capital to expand beyond our 12-satellite constellation already in orbit as well as the four satellites due to launch in 2H 2022.

“Increasing global risks and conflicts have driven growth in demand for intelligence, surveillance, and reconnaissance data. With each new cluster of satellites we operate, we increase our data collection capacity as well as revenue generation opportunities.”

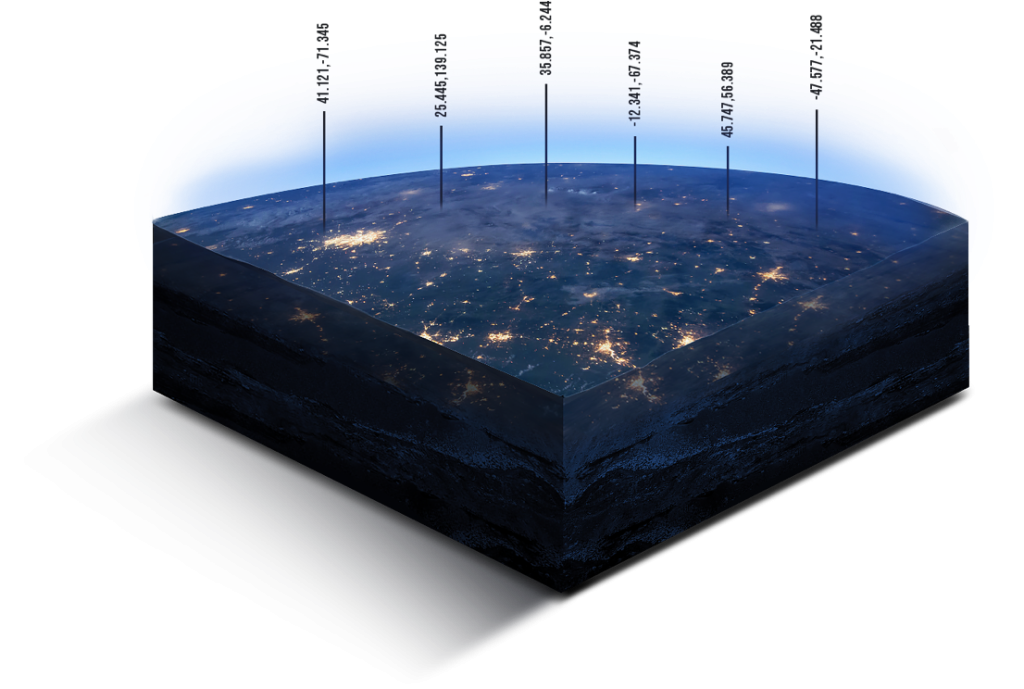

Kleos uses space technology to locate radio transmissions (RF) in key areas of interest around the globe, efficiently uncovering and exposing activity on land and sea. Using Kleos’ owned clusters of satellites, RF data is collected, transmitted to the ground, processed using proprietary technology, and delivered to customers worldwide.

Customers include analytics and intelligence entities who license data on a subscription basis (DaaS) or purchase dedicated data collection capacity (MaaS). The geolocated RF data is applicable to government and commercial use cases, aiding better and faster decision making.

Kleos will use the PURE facility funds to further expand its low earth orbit constellation beyond the satellites already scheduled for launch H2 2022 and increase its operational team to support growth.

“We have been impressed with the level of genuine commercial interest in Kleos’ offerings from a broad array of sophisticated Government bodies globally, in undertaking our due diligence,” said PURE Asset Management co-founder Nick Berry.

“Kleos faces limited competition in a rapidly scaling market, and its commercial prospects are divorced from the monetary policy considerations currently driving macro-economic trends. We’re excited to be partnering with Kleos at this inflection point in the Company’s commercial trajectory.”

A summary of the key loan terms is in the attached Appendix.

This announcement has been authorised by the CEO of Kleos Space S.A

—

Appendix: Summary of key terms of the Loan Facility

- A$10,000,000 of secured term loan facility, comprised of:

- Tranche 1: A$6,000,000

- Tranche 2: A$4,000,000

- Four (4) years to maturity (from date of utilisation)

- Annual interest rate of:

- 12.00% per annum until monthly revenue for three consecutive months exceeds EUR1,200,000;

- 10.00% per annum once monthly revenue for three consecutive months exceeds EUR1,200,000 (with no ability to return to the higher rate above if revenue subsequently decreases); and

- 8.50% per annum once monthly revenue for three consecutive months exceeds EUR2,000,000 (with no ability to return to the higher rate above if revenue subsequently decreases); or

- 15.00% per annum while a Review Event or Event of Default is subsisting.

- Grant of the following unlisted detached warrants:

- Tranche 1 Warrant Shares: the number of Shares equal to the Tranche 1 Loan plus 25% of the Tranche 2 Loan divided by the Tranche 1 Exercise Price, as calculated at the time of issuance, with exercise price being the lower of:

- A$0.85;

- 70% premium to the trailing 20-day volume weighted average price (VWAP) on the day immediately prior to the Facility being announced on the ASX; and

- Tranche 2 Warrant Shares: the number of Shares equal to 75% of the Tranche 2 Loan divided by the Tranche 2 Exercise Price, as calculated at the time of issuance, with the exercise price being the lower of:

- A$1.20;

- 70% premium to the trailing 20-day VWAP immediately prior to the utilisation date in respect of Tranche 2

- Tranche 1 Warrant Shares: the number of Shares equal to the Tranche 1 Loan plus 25% of the Tranche 2 Loan divided by the Tranche 1 Exercise Price, as calculated at the time of issuance, with exercise price being the lower of:

- Early repayment penalties ratcheting down from 4.00%, 2.75%, 0.75% to 0% over the facility amount as it gets closer to maturity date

- First-ranking security over all present and after-acquired property of the Borrower and each Guarantor

- Corporate guarantees and other standard covenants applied.